Buy now pay later – Adding a new dimension to e-Retail.

Buy Now Pay Later – A Fintech product.

One of the sectors that saw huge spike in usage was undoubtedly ecommerce, logistics and fintech companies.

Buy now pay later is one such fintech solutions which is disrupting banking sector especially credit cards.

What is Buy Now Pay Later (BNPL)?

Buy Now Pay Later (BNPL), as the name suggests, is a micro-credit instrument.

It’s function is similar to credit card, that I allows consumer purchases just as a credit card.

BNPL users get to split their eligible online or offline purchases, i.e. purchases made with partnering merchants, into zero-to-low interest instalments or repay the total dues at a later date within the repayment cycle at no interest charges, according to the terms and conditions of the BNPL service provider.

For example, if you buy something in a store or online, you may be offered the buy now, pay later option at checkout.

If you get approved, you usually make a small down payment at the checkout.

You would then pay off the remaining balance in a series of interest-free instalments.

Why so much noise for “Buy Now Pay Later”?

Pandemic has changed the way we shop or our buying behaviour,

Convenience is the buzz word and if it comes with easy credit facility then it becomes a trend. (in urdu we say, sone pe suhaga, means cherry on top of the cake)

Global e-commerce transactions totalled $4.6 trillion last year, up 19 per cent from 2019, a report from Worldpay says.

BNPL accounted for 2.1 per cent or about $97 billion of that sum. (source: worldpay)

So, when you are talking about a trillion dollars sector, then it gets all the attention it needs in the marketplace.

There are a number of BNPL players vying for a share of the Middle East market, including Spotii, Postpay, Cashew, Tabby and Tamara. Australia’s Zip, a global BNPL platform, bought Spotii for $16.25 million in May this year.

Learn how to develop your Influencer Marketing Plan, Click here.

Why Millennials are in love with Buy Now Pay later (BNPL)?

Millennials hate conventional banking.

They are not interested in high interest rates on cards, and recurring fees.

Convenience of easy on-boarding. (Hassle free documentation of BNPL attracts them).

BNPL service providers often use new-age mechanisms to evaluate the creditworthiness of an applicant; thus, the customer onboarding process is usually fast and convenient with zero documentation requirements or joining charges.

The entire process is digitally enabled through internet-connected mobile devices or apps.

Upon approval, a BNPL service provider issues a line of credit based on its assessment of the user’s creditworthiness and income.

After signing up, users can visit a partnering merchant application, website or offline store (in some cases), add the desired items to the shopping cart, and select their BNPL provider’s payment option at ‘check out’ to buy the selected items in a secure one-tap manner.

Users can then convert their dues into zero-to-low interest EMIs, according to the terms and conditions of their BNPL service provider.

These BNPL companies are operating like mini banking institutions wherein they incentivize the purchase with cash backs, extended credit facility etc.

How does BNPL operate?

The main premise of Buy Now Pay later companies is “Consumerism is here to stay”

Ritesh Mohan

“Why wait for tomorrow when you can have your favorite gadget or dress today at equated monthly installments, which are interest free”

BNPL player’s services or model help countless customers, especially the ones who have just started working, to better manage their expenses by allowing them at least a few weeks to make the repayments.

BNPL services, thus, are rewarding spending tools for those who are yet to recover from the many financial shocks of the pandemic-induced lockdowns or are outside the credit card ecosystem.

Word of Caution- Buy now pay later

Customers must keep in mind that a BNPL facility is still a loan that needs to be repaid in full on time to avoid penalties and an adverse impact on their credit scores.

Learn about “Hyper Personalization”, click here.

Challenges for customers using BNPL option:

Since the sector is in its developing stage, following are some challenges.

- Customer and Merchant acquisition

- Getting both customers and merchants to come online with BNPL player is one such challenge, however BNPL players are identifying themselves as more of the omnichannel solution providers to the retailers in order to mitigate the risks involved.

- Goods returns

- Returns can be an issue, too.

If you return an item, it can take substantial time and effort to have the BNPL credit provider acknowledge the return.

You may still be obligated to pay your installments till the issue is resolved

How does the BNPL players make money?

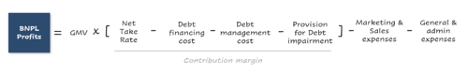

At the outset, the financial looks similar to that of credit card company.

- Net take rate represents the commission charged to merchants (Take rate) minus payment processing fees that the BNPL company pays.

- Debt financing cost corresponds to the interest BNPL providers pay banks for liquidity (to provide loans to their customers).

Debt management cost equals the credit check costs plus payment collection costs minus late fee payments collected from customers. - Provision for debt impairment is the weighted average percentage of loans that are not paid back (i.e., bad debt)

- GMV refers to Gross Merchandising Value, the sum of all payments conducted on the BNPL platform.

- Marketing and sales expenses are the expenses incurred as BNPL providers acquire and onboard both merchants and customers to their platform.

- General and administrative expenses include team salaries, technology, and other infrastructure costs.

Let’s take an example: Suppose your net take rate is 5% (assuming merchants pay you 6% and you pay 1% in payment processing fees). If you pay 1% interest on your loan, and it costs you 1% to manage consumer loans, the percentage of your non-performing loans can’t exceed 3%; otherwise, you lose money.

Profitability for BNPL or for that matter with any tech firms is based on

- Scalability – acquire more customers and merchants.

- Incentivize the purchases especially up-selling using BNPL product.

- Negotiate better terms with both Merchants and Banks (for debt financing cost).

- Access more data on customer’s spending and build a separate data insight report for the merchants to buy and take benefit.

Buy now pay later – a boon for ecommerce sites.

- Reduce cart abandonment rate.

This is the main challenge for any ecommerce site is to reduce the cart abandonment as over 40% traffic that comes on to the site, leaves the cart without click on the “Buy now” tab.

- Improves the basket size by means of upselling. Hence your average transaction value increases along with the average transaction quantity.

- Ecommerce retailer gets their full payment while their customer enjoys installment plans. This helps in customer retention and build trust.

- Lower customer acquisition cost- Increase in sales for the same amount of efforts done in getting the online traffic through marketing efforts.

- Attracts first time buyers with the installment option at the time of check-out.

Increase in CLV:

Customer lifetime value (CLV) is the total amount a person spends at your store over their lifetime as a customer.

Since the cost of earning new customers is up by over 50% in the last five years, keeping your current customers is more valuable every day.

Summary

Providing your customers with many payment options is essential to boost customer experience and it can help you convert more shoppers into paying (and loyal) customers.

Buy Now Pay Later option just does it.

It’s a win-win option for both fintech BNPL players, Banks, Merchants and consumers.

References: The Guardian.com, Observer’s Fintech , thefinancialexpress.com , worldplay.

About the Author

Ritesh Mohan is a passionate retail professional with over 22 years in the Retail sector, handling some of the biggest brands in the beauty, fashion, and fragrances retail & FMCG sector.

He has been instrumental in the growth of some of the regional brands as well in the Middle East region.

Ritesh specializes in Retail management, Product development, and Brand Management, Retail Operations, Sales Management, and Franchising & Business Management.

He strongly believes in empowering business owners with his wisdom & experience of around two decades in the industry.

follow me on Instagram as @mohanritesh & on Youtube as @riteshmohan